Safestore Holdings plc (LON:SAFE) has announced its first quarter trading update for the period 1 November 2022 to 31 January 2023.

Highlights

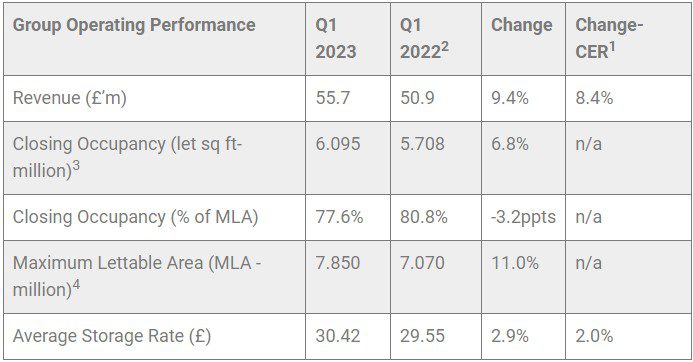

Group revenue for the quarter in CER1 up 8.4% and 9.4% at actual exchange rates

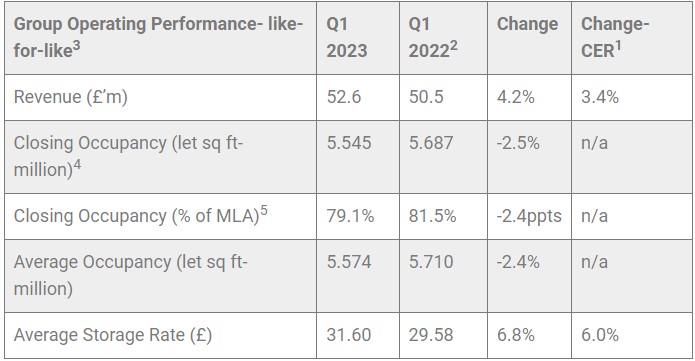

Like-for-like5 Group revenue for the quarter in CER1 up 3.4%

- UK up 3.5%

- Paris up 2.6%

- Spain up 7.1%

Like-for-like5 average rate for the quarter up 6.0% in CER1

- UK up 7.2%

- Paris up 1.0%

- Spain up 8.5%

Like-for-like5 occupancy at 79.1% (2022: 81.5%)

- UK down 3.3ppts at 78.7% (2022: 82.0%)

- Paris up 1.5ppts at 80.7% (2022 79.2%)

- Spain down 4.9ppts at 80.8% (2022: 85.7%)

As previously reported, Revolving Credit Facilities (RCF’s) refinanced with a new increased £400m unsecured multi-currency four-year facility (with two one-year extension options) in November 2022. Margins remain at 1.25% in line with previous RCF’s and all facilities, including private placement notes, are now unsecured.

- Group Property Pipeline of 1.5m sq ft representing c. 19% of the existing portfolio.

- Two new sites secured in Ellesmere Port in the UK and in Central Barcelona adding 69,700 sq ft of MLA.

- Edinburgh leasehold re-geared and freehold of Valencia store acquired in Barcelona.

- Acquisition of 58,000 sq ft existing storage facility in Apeldoorn in the Netherlands.

- Entry into German market via a new Joint Venture with Carlyle which has acquired the seven-store myStorage business with 326,000 sq ft of MLA4.

Frederic Vecchioli, Chief Executive Officer, commented:

“I am pleased to report that the solid early trading indicated in our January 2023 announcement has continued through to the end of our first quarter with the Group delivering like-for-like revenue growth of 4.2% and total revenue growth of 9.4% (3.4% and 8.4% respectively on a CER basis).

We have opened two new stores in the period in Spain, acquired an existing operation in the Netherlands and added two stores in the UK and Spain to our pipeline which, at 1.5m sq ft, now represents 19% of our existing portfolio’s MLA. We anticipate the pipeline will continue to grow over the coming months. Our strong and flexible, recently refinanced balance sheet has significant funding capacity, allowing us to continue to consider and execute strategic, value-accretive investments as and when they arise.

Alongside our attractive development pipeline, we continue to prioritise the significant upside from filling our 1.8m square feet of fully invested, currently unlet space. The business has demonstrated its inherent resilience in recent times and we look to the future with confidence. The first quarter’s trading performance has provided us with a solid base for the rest of the financial year and we anticipate that the business delivers Adjusted Diluted EPRA Earnings per Share7 for 2022/23 in line with the consensus of analysts’ forecasts8“.

Business Highlights

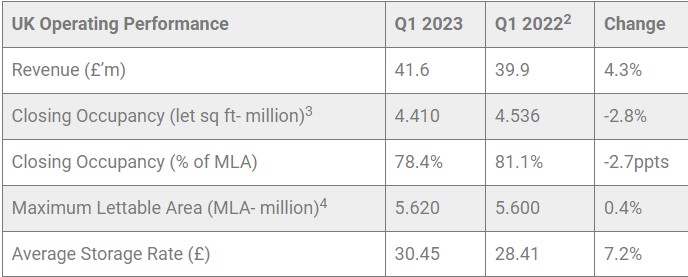

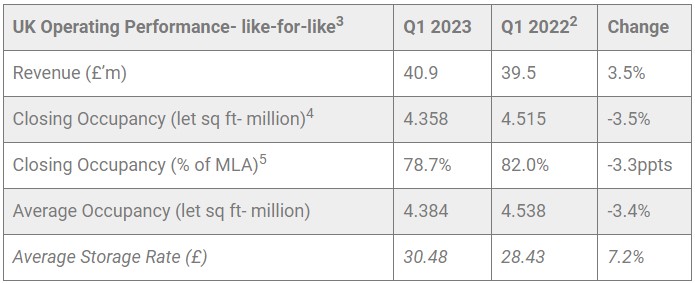

UK Trading Performance

The UK performed solidly in the first quarter with total revenue up 4.3% and like-for-like revenue up 3.5%, driven by a continued strong average storage rate increase of 7.2%, offset by a reduction in average occupancy of 3.4%, where we have seen a return to a more normal cycle of trading in the current financial year. In the first quarter, as anticipated, we have seen an occupancy outflow as is typical for the period (which is our low season). The average storage rate grew sequentially by 2.9% compared to the fourth quarter of 2022.

As ever, the Group looks to find an appropriate balance of rate growth and occupancy performance in order to maximise revenue.

Enquiry levels for the first quarter, whilst slightly behind the same period in 2022, remained significantly ahead of the pre-pandemic period.

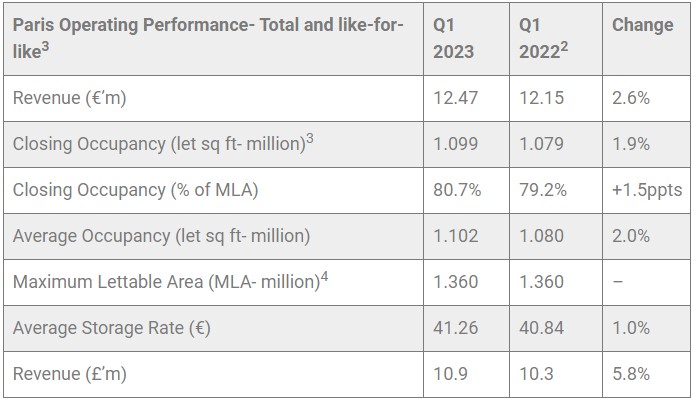

Paris Trading Performance

Our Paris business had a solid quarter growing total revenue by 2.6% year-on-year.

Like-for-like occupancy performance was robust for the quarter with closing occupancy at 80.7%, up 1.5ppts compared to Q1 2022. As we return to a more normal cycle of trading in the current financial year, we have seen a modest occupancy outflow in the period as expected and which is typical for the first quarter (our low season).

The like-for-like average rate was up by 1.0%, and together with the increase in like-for-like occupancy, drove the like-for-like revenue growth of 2.6%.

The average storage rate grew sequentially by 0.8% compared to the fourth quarter of 2022.

Sterling equivalent like-for-like revenue was impacted by the 3.3% weakening in the Sterling: Euro exchange rate for the quarter compared to Q1 2022. As a result, sterling equivalent total and like-for-like revenue grew by 5.8% compared to Q1 2022.

Enquiry levels for the first quarter were slightly ahead of the same period in 2022 and significantly ahead of the pre-pandemic period.

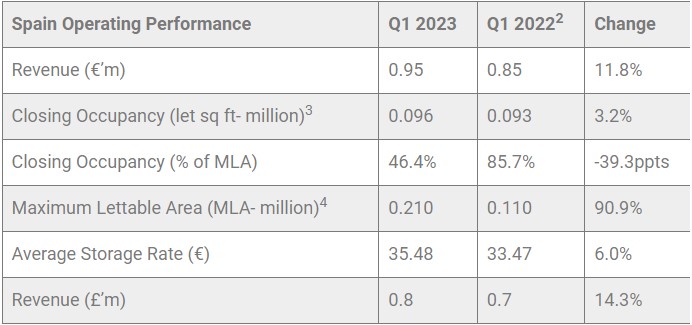

Spain Trading Performance6

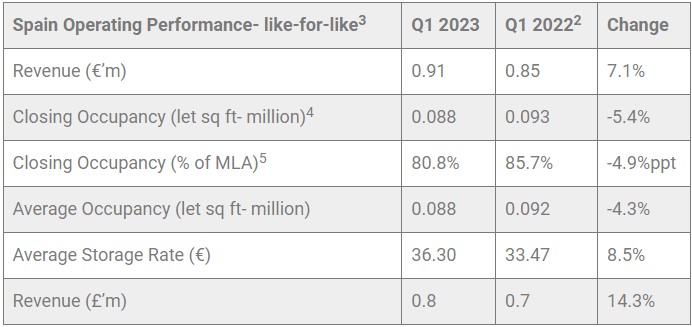

In the quarter, our Spanish business saw a strong 11.8% and 7.1% growth in total and like-for-like revenue respectively.

The like-for-like average storage rate grew by 8.5% to €36.30 compared to €33.47 for Q1 2022. This rate grew sequentially by 3.7% compared to the fourth quarter of 2022. This increase in the like-for-like average rate, offset by a reduction in like-for-like average occupancy of 4.3%, drove the like-for-like revenue growth of 7.1%.

The reduction in total occupancy to 46.4% reflects the dilutive effect of the three recent store openings.

Sterling equivalent like-for-like revenue was impacted by the 3.3% weakening in the Sterling: Euro exchange rate for the quarter compared to Q1 2022. As a result, sterling equivalent total and like-for-like revenue grew by 14.3% compared to Q1 2022.

Following the acquisition of four stores in Barcelona just over three years ago, the business has already opened three new sites and has added a pipeline of seven stores across Barcelona and Madrid and we look with confidence to the continued expansion of the portfolio.

Benelux Trading Performance

Our Netherlands and Belgium businesses, acquired on 30 March 2022, contributed €2.7m revenue in the period.”

The Benelux businesses grew revenue by 2.2% (excluding the newly acquired Apeldoorn site as set out below) compared to the fourth quarter of 2022 and the businesses ended the period with a combined closing occupancy of 74.2%.

The business was originally established in 2019 with the acquisition of six stores and was subsequently developed into a 16-store portfolio with a pipeline of five additional stores.

Refinancing

The previous £250m sterling and €70m euro secured RCFs have been replaced with a single multi-currency unsecured £400m facility.”

In November 2022, the Group completed the refinancing of its revolving credit facilities (RCFs) which were due to expire in June 2023.

The previous £250m sterling and €70m euro secured RCFs have been replaced with a single multi-currency unsecured £400m facility. In addition, a further £100m uncommitted accordion facility is incorporated into the facility agreement.

The facility is for a four-year term with two one-year extension options exercisable after the first and second years of the agreement.

Further detail is included in our Results Announcement of 17 January 2023.

Property Pipeline Developments

Openings in the period

Northern and Southern Madrid

In March 2021 and April 2021, the Group exchanged contracts on two freehold buildings in Southern Madrid and Northern Madrid, respectively. Both existing buildings have been converted into 32,000 and 53,000 sq ft MLA self storage facilities and were opened in November 2022.

New Development Sites

Ellesmere Port- UK

In Ellesmere Port in Northwest England we have secured a new freehold development site, located in an accessible position near junction 8 of the M53 on the affluent Wirral Peninsular. A 55,000 sq ft MLA new build store should open in late 2023.

Spain

A new leasehold site in Central Barcelona (Central Barcelona 3) has been acquired. The existing building will be converted into a 14,700 sq ft MLA store and is expected to open in 2023. The building has planning permission and the lease is 30 years in length.

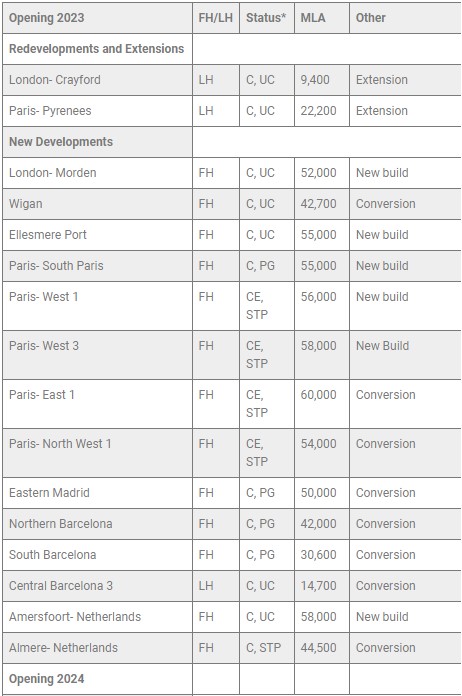

Pipeline Summary

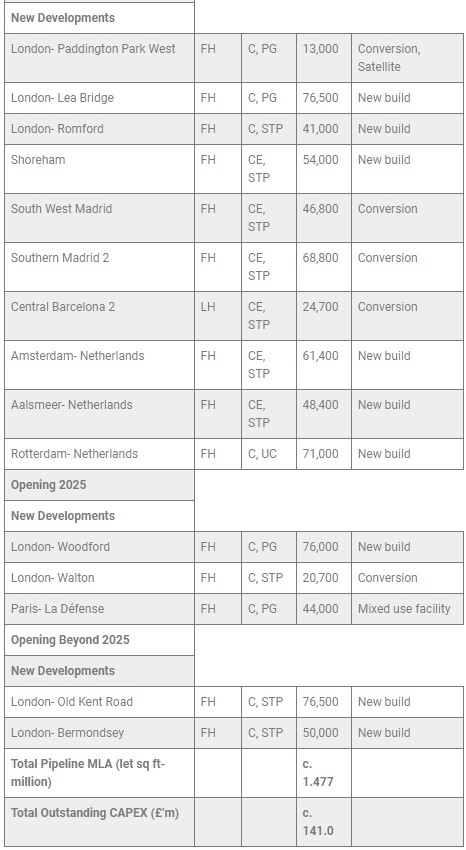

We are leveraging our effective and scalable operating platform to increase our expansion plans across both the UK and continental Europe. This approach has resulted in the largest development pipeline in our history. This pipeline of c. 1.5m sq ft represents c. 19% of our existing property portfolio.

In the first quarter of the 2023 financial year, c. £25m has been spent on the new store openings, the Valencia freehold acquisition, the acquisition of the Apeldoorn site in the Netherlands and the pipeline stores.

*C = completed, CE = contracts exchanged, STP = subject to planning, PG = planning granted, UC = under construction

Lease Extension

During the period we have completed the extension of our lease at Edinburgh Fort Kinnaird store. The lease has been extended by a further 10 years to 2040.

Freehold Purchase

In Barcelona, the Group has been leasing its Valencia store since 2013. During the period, the freehold of the site was acquired for €3.6m.

Acquisition of Apeldoorn Self-Storage Facility in the Netherlands

During the period, the Group completed the acquisition of an existing 58,000 sq ft self storage facility in Apeldoorn in the Netherlands. The store was operating under the Stoor brand and is situated in an easily accessible commercial and logistics district on the north side of the city, which has a population of 165,000.

New Joint Venture with Carlyle and Investment in myStorage in Germany

Safestore’s initial investment in the Joint Venture was a c. €2.2 million equity investment for a 10% share of the Joint Venture. Safestore will also earn a fee for providing management services to the Joint Venture. The Group expects to earn an initial return on investment of c. 15% for the first full year before transaction-related costs reflecting its share of expected joint venture profits and fees for management services.”

As announced in December 2022, Safestore has entered the German self storage market via a new Joint Venture with Carlyle, which has acquired the myStorage business.

Safestore has developed a multi-country highly scalable platform with leading marketing and operational expertise in self storage, with a proven track record for developing its platform in new markets.

The acquisition of myStorage represented an excellent opportunity to develop our platform into the attractive German self storage market. The Joint Venture builds upon our previous successful relationship with Carlyle having entered the Benelux market in 2019. Our common intention is to target development and acquisition opportunities through the Joint Venture, providing the opportunity to achieve operational scale and to develop local market knowledge, whilst also retaining the option for Safestore to develop its own wholly owned self storage sites in Germany. We look forward to continuing our working relationship with Carlyle, and to developing a long and mutually beneficial relationship.

The German market is one of Europe’s more under-penetrated markets with just 0.09 sq ft of storage space per capita which compares to 0.76 sq ft in the UK, 0.24 sq ft in France, 0.24 sq ft in Spain, 0.60 sq ft in the Netherlands and 0.20 sq ft in Belgium. According to the 2022 FEDESSA report, there are just 320 facilities in Germany and 7.6m sq ft of lettable space.

myStorage has seven medium to long-term leasehold stores and 326,000 sq ft of MLA in Berlin, Heidelburg, Mannheim, Fürth, Nuremburg, Neu-Ulm, and Reutlingen.

On acquisition, the occupancy of the portfolio was 67% with two of the stores having opened in 2021.

Safestore’s initial investment in the Joint Venture was a c. €2.2 million equity investment for a 10% share of the Joint Venture. Safestore will also earn a fee for providing management services to the Joint Venture. The Group expects to earn an initial return on investment of c. 15% for the first full year before transaction-related costs reflecting its share of expected joint venture profits and fees for management services.