Go Store Self Storage completed an expansion of its facility in York, England. The property on Monks Cross Drive comprises 45,000 square feet in 950 units. The company secured a seven-figure funding package from lender HSBC UK as well as £150,000 for ongoing capital improvements. Go Store has a second location under development in Kettering, England. Norway-based Self Storage Group ASA (SSG) has purchased a property in Trondheim, Norway, for NOK 17 million on which it intends to build a new facility. Expected to open in the second quarter of 2023, the 1,550-square-meter…

Category: Finance News

UK Self-Storage Operator Storage King Secures £50M to Fund Expansion

Storage King, which operates 29 self-storage properties in the United Kingdom, has secured £50 million in funding from British banks HSBC UK and Santander UK to help fuel future growth. The company intends to expand several existing sites as well as add two to four new facilities annually over the next five years, according to a press release. The Storage King portfolio has performed well over the last 18 months, growing in physical occupancy from 75% to 90%, the release stated. The company attributed the progress to increased demand stemming…

Go Store Self Storage Opens In York After Securing Seven-Figure Funding Deal

A storage company has expanded its UK operations with a new Yorkshire site after a rise in demand during the pandemic. Go Store Self Storage used a seven-figure funding package from HSBC UK to support the build and fit-out a 45,000 sq ft storage centre at Monks Cross, York. The site includes 950 storage rooms with 35 different sizes available. An additional £150,000 was also provided by the bank to support the company’s ongoing working capital requirements. Rory Windham, managing director at Go Store Self Storage, said: “The pandemic changed…

Stor-Age Outshines Other JSE Property Competitors, Continues To Experience Strong Growth

STOR-AGE, South Africa’s largest self storage property fund, lifted its interim dividend 8.85 percent to 56.60 cents per share after it continued to outperform other listed property companies on the JSE in the six months to September 31, 2021. The results were driven by strong demand, growth in occupancy and rental rates, and disciplined cost control at a property level, said chief executive Gavin Lucas. He said even though the business model was tested over the past 18 months, “we made progress in all areas of our strategy: organic growth,…

Aviva Investors Provides Further £50 Million to Self Storage Firm Big Yellow Group

Aviva Investors, the global asset management business of Aviva plc, announces that it has completed a further £50 million financing agreement with Big Yellow Group, the UK-based self storage company, as it continues to expand its sustainability-linked financing programme. This facility includes a set of sustainability goals and indicators which are ambitious and fully aligned with our Sustainable Transition Loans framework, as we continue to seek ways of making sustainability a more material consideration for borrowers and support the transition towards a low-carbon future.” The loan, a seven-year facility, is…

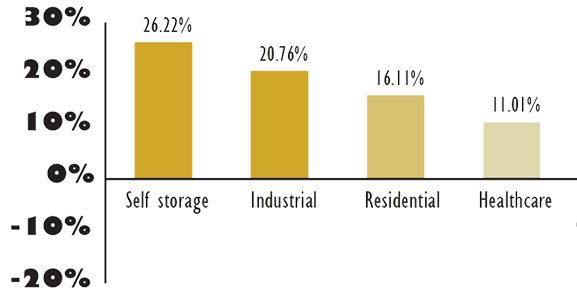

The Role of Property in Portfolios Today

Investors in UK commercial property have experienced a rollercoaster ride over the past 18 months. When Covid-19 took hold in March of last year, the picture looked bleak, to say the least: as the UK went into lockdown, several sectors stepped into the unknown. The UK’s largest open-ended direct property funds suspended trading, while commercial property real estate investment trusts (REITs) swung to big discounts as panic set in. This was reflected in the FTSE Epra Nareit UK index, which plunged 32% between 1 February and 20 March 2020. More…

Stor-Age Shouldn’t Be Ignored

Since listing in late 2015, self storage property specialist Stor-Age has hardly put a foot wrong. Without stretching its balance sheet, it has built sturdy growth legs in SA and the UK. Like financial services specialist Transaction Capital (which listed three years earlier), it came to market with a fresh and innovative offering. But while transaction capital has been riding high, the market has still not properly grasped the longer-term growth and value proposition at Stor-Age. The share, in fact, trades roughly at NAV. Some punters may see this as…

Austria Self Storage Operator Storebox Raises €52 Million to Expand Services, European Footprint

Storebox Holding GmbH, a Vienna-based self storage, warehousing and logistics startup, has raised €52 million in a Series B investment round to increase its presence and services across Europe. The company intends to expand its last-mile delivery capabilities by adding multi-functional warehouses for use by business and residential customers as well as to grow its franchise base, according to a press release. With this investment, we aim to open thousands of locations in Europe over the next few years and to become the market leader in micro-logistics hubs to provide,…

Cinch Self Storage Purchases Brighton, England Facility

Cinch Self Storage, which operates six locations in England, acquired a facility in Brighton, England. The property at The Depository, South Road comprises 12,500 square feet. Financing was provided by Lloyds Bank. Cinch operates locations in Bicester, Chippenham, Huntingdon, Letchworth and Leighton Buzzard. Source

Heitman Raises $3.2 Billion for Three New Funds to Invest in Self Storage, Other Commercial Real Estate

Real estate investment firm Heitman LLC has raised $3.2 billion to launch three new funds that will seek commercial real estate investments focused on apartments, medical offices, senior and student housing, self storage and warehouses. It will also use funds to repurpose existing retail and office buildings as hospitality, mixed-use and residential properties, according to the source. Heitman Value Partners V will focus on North American opportunities, while Heitman Real Estate Debt Partners II and Heitman Global Real Estate Partners II will specialize in high-yield credit. Capital infusion came from…