Investors in UK commercial property have experienced a rollercoaster ride over the past 18 months.

When Covid-19 took hold in March of last year, the picture looked bleak, to say the least: as the UK went into lockdown, several sectors stepped into the unknown.

The UK’s largest open-ended direct property funds suspended trading, while commercial property real estate investment trusts (REITs) swung to big discounts as panic set in. This was reflected in the FTSE Epra Nareit UK index, which plunged 32% between 1 February and 20 March 2020.

More than a year and a half later, things are looking brighter. The average prime yield stood at 5.13% in July, according to Savills, the lowest level since March 2020, while commercial property investment volumes reached £31.4bn, a 32% increase year-on-year.

The Nareit UK index has also recovered from its March 2020 lows, and at the time of writing was only 1.1% lower compared with February 2020.

However, a closer look behind these headline figures reveals the stark divergence in performance between different property subsectors.

While discretionary retail, office, leisure, hospitality and student accommodation were hit hard by the lockdowns, healthcare, self storage, logistics and supermarkets stayed open and largely collected their rents, with little impact on dividends.

‘Over the course of the last 18 months, areas that already had a bit of a tailwind have accelerated, while others have seen challenges continue to mount,’ said Luke Hyde-Smith, head of third-party fund selection at Waverton Investment Management and manager of the firm’s Real Assets fund.

Finding value

With restrictions eased and normality gradually returning, investors have been left to assess the damage and consider whether there is value to be found in parts of the market that struggled during the pandemic.

This raises two important questions: first, do certain subsectors offer attractive recovery plays? And second, does it make more sense to rely on the stable, inflation-linked income streams on offer from specialist Reits?

Adam Ross, an investment director at Canaccord Genuity Wealth Management, said parts of the UK commercial property market have experienced a recovery in capital values, particularly since the vaccine announcements last November.

However, he believes there are fewer opportunities today than six to eight months ago. ‘There were definitely opportunities for capital growth, and some areas of the market still potentially offer value,’ he said.

He cites Regional REIT, which invests in offices in regional centres outside the M25 and features on Canaccord’s buy list, as a prime example.

‘It trades on quite a reasonable discount to the underlying assets it owns [9% at time of publication], and yields 7.2%,’ he said. ‘Given the outlook in that market, we think you are being paid relatively well for that potential extra risk and lack of visibility on how quickly people come back to offices.’

Ross’s optimism does not extend to retail REITs, however, where he is concerned about the potential headwinds facing the sector, not least the growth of online shopping.

Although some clients with a higher appetite for risk may have a small exposure to offices – representing a recovery play – Ross said REITs with longer-dated, inflation-linked leases, like LXI and Secure Income, form core allocations.

‘In a world of 4% inflation, which is where we are today, they are quite attractive, stable investments and have good quality, underlying tenants and counterparties,’ he said. ‘This is a way of getting relatively stable returns.’

Hyde-Smith echoed these sentiments, noting that the past 18 months have highlighted the attractions of certain asset streams, particularly those offering inflation protection. These include Supermarket Income and Primary Health Properties (PHP), which invests in medical centres and GPs in the UK and Ireland.

‘You can get very secure, contracted, almost government-esque cashflows from the likes of PHP, which are pretty limited in terms of net asset value volatility. You would expect the income to be very secure in the long term,’ he said.

Hyde-Smith also likes funds that seek to add value to the properties they own via active management. He named Industrials REIT, formerly Stenprop, as a good example.

The death of the high street?

Despite the recent retail relief rally, Matthew Norris, manager of the Gravis UK Listed Property fund, agreed with Ross that there is too much uncertainty facing the sector.

‘As the economy has reopened, retail REITs have performed very well – but we are not in that game,’ he said. ‘I don’t think we are going to come out of the lockdowns with retailers saying they need more space and are willing to pay their landlords more rent. They are more likely to say they need less space and want to pay less rent.’

Coming out of the lockdowns, retailers are likely to say they need less space and want to pay less rent.“

For those thinking about the potential impact of new variants and future lockdowns, Norris said the divergence in performance of different subsectors during the pandemic can be viewed as an indicator of what could lie ahead.

‘I would expect to see the same again. In offices, bosses will say “work from home if you can”. If the university sector moves online, some students will go home, so rent collection will vary from collecting only half of the rent to most of the rent.’

The strong get stronger

Norris likes sectors with structural tailwinds, such as logistics. As a proportion of total sales, online trading now makes up about 27% in the UK, up from 20% before the pandemic – a 12-month increase that would typically have taken five years.

As tenants including Ocado and Amazon invest in robotics within their warehouses, spending more than the building is worth, Norris suspects they will end up staying for 20 years and continue to pay their rent.

‘Logistics fundamentals have never been better,’ said Jamie Boyes, manager of the Catalyst Global Real Estate fund, referencing the onshoring of supply chains. He expects further rental growth, given how small rent is as a percentage of total supply chain costs, particularly in comparison with labour and transport.

‘Rent costs are 4-5% of the overall cost. If you pay 7% rather than 5% [for rent], but you are in the right location with the right facilities, it could take your transport cost from 50% to 45%, which would be a good result,’ he said.

Office market schism

Boyes’ optimism does not extend to the office sector, however, where he expects to see ‘massive bifurcation’ over the coming years. This will be caused by companies opting to rent modern, ESG-friendly buildings that can meet the changing needs of their staff, a demand he expects will leave older buildings by the wayside.

But if employees return to the office for three to four days a week, Boyes suspects this may not result in companies taking less space.

Despite the uncertainty, he says some businesses look attractively priced. Around 6% of his portfolio is in offices, including Derwent and Great Portland Estates, two companies known for actively turning over their portfolios – a characteristic he says will prove even more important in today’s environment.

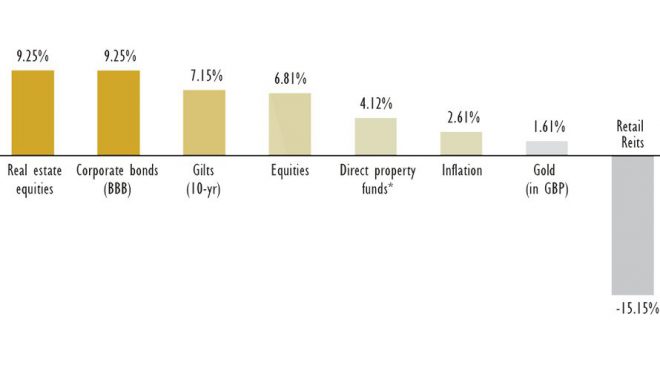

How do asset class returns compare?

10-year annualised return by asset class (31 Aug 2011–31 Aug 2021)

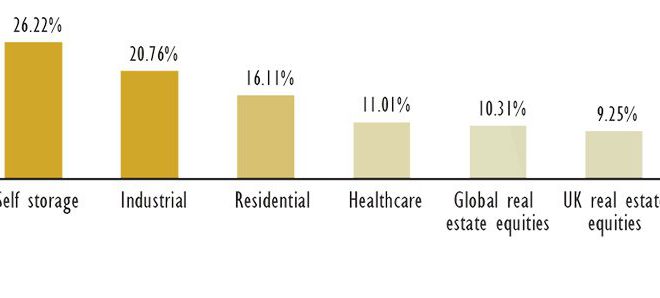

REIT sector returns

10-year annualised return by sector (31 Aug 2011–31 Aug 2021)

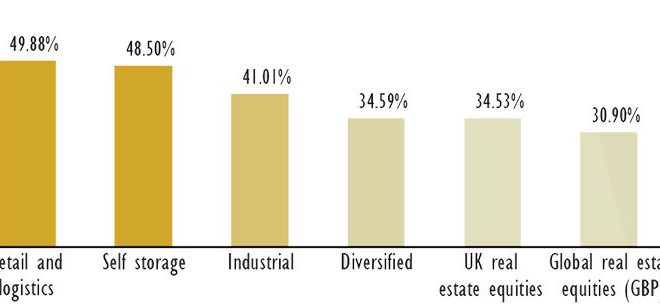

12-month return by sector (31 Aug 2020–31 Aug 2021)

Norris suspects climate change will prove to be an even bigger issue for the office sector than the pandemic. For example, commercial buildings will need to have an energy efficiency rating of at least B by 2030.

If this is not achieved, the building cannot be leased or re-leased. ‘If you can’t lease it, you don’t get any rent, which means the end-investor is not getting any dividend,’ he said.

Boyes also highlighted a ‘trinity of green forces’ likely to define fortunes in the office market. First, tenants will want to be in green buildings that resonate with their corporate values, which will lead them to modern properties. Second, institutional investors prefer buildings that meet ESG criteria. And on the financing side, banks tend to favour green loans. With this in mind, he said there is a chance that older buildings become stranded assets.